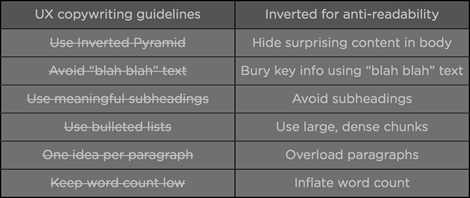

A skilled black hat copywriter can create a page of content that says one thing when read at-speed (i.e. by normal web users) but says another thing entirely when carefully read word-for-word (e.g. from a legal perspective). Small print and footnotes are a classic examples of this. Black hat copywriting basically involves subverting well known UX copywriting guidelines, so readers are deceived rather than informed:

Now let’s look at an example on Creditexpert.co.uk – a site that allows you to check your credit rating in the UK. The homepage mentions the word “free” all over it:

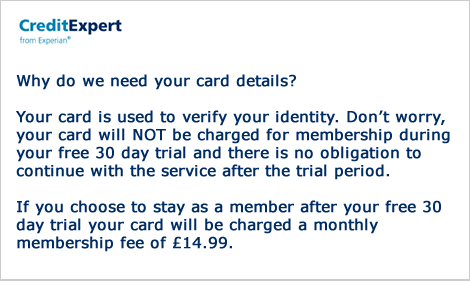

If you click the big orange button, you are taken through a wizard in which the site collects your personal details. Then, you get to a page in which you are asked to enter your credit card details (view screengrab as PDF). It’s fairly likely that when you reach the credit card form, you’ll think to yourself “Huh? I thought this was free, why are they asking for my card details?”. The designers of this page must have expected this, as they headed it off with some explanatory text.

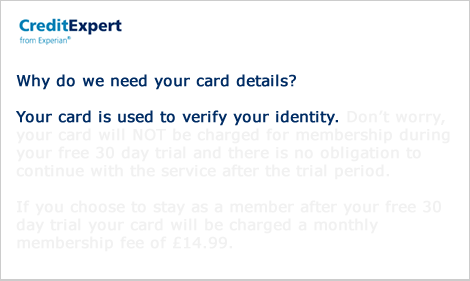

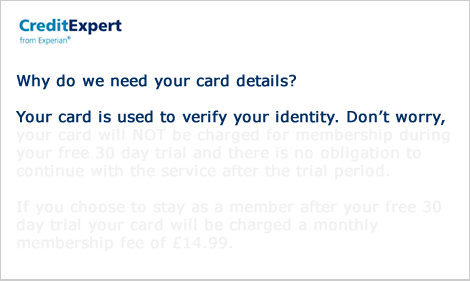

I’m sure you’re familiar with the idea of “honest” inverted pyramid copywriting: you give an accurate summary up-front, then go into progressive layers of detail, so the reader can stop at any time and still have a clear idea of what it’s all about. What we’ve got here is a “black hat” inverted pyramid, which gives a misleading message upfront, then hides the facts lower down. Let’s see it in action here:

The beginning of the message seems to tell you that your card will not be charged and that it’s just an identity verification thing. If you go on to read a bit more, then you’ll be further reassured:

And then if you read a little bit more, you’d be feeling even more reassured:

If you read the whole thing through to the end, you’ll see the real message- that the free trial rolls over into a surprisingly expensive paid plan, which will continue for the rest of your life unless you cancel.

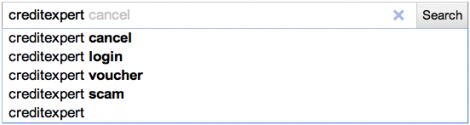

You might argue that this is just grey hat copywriting – and that if it were black hat, they could have taken the final sentence and hidden it in a footnote to bury the key message even further. Maybe so, but their approach is enough to catch a certain number of people out. Just take a look at the Google instant autocomplete suggestions on Google.co.uk if you type the word “creditexpert” followed by a space:

Edit: Malcom Coles has shown that Google Instant suggestions are not a great predictor of scammy-ness. Even so, I’d be wary of simply blaming Google if this happens to you.

To conclude, let’s take a look at some consumer reviews:

“…veering on criminal in their billing methods” – ciao.co.uk

“Two months later, and they are still charging me £6.99 per month.” – ciao.co.uk

“What a useless ****ing service. Who needs to know their credit rating on a monthly weekly daily basis? May be once in a blue moon any more and you have mental problems.” – complaintsboard.com

“I too fell for the ‘FREE’ credit report for myself & my wife. Having requested credit card details ‘to complete the report’ I then find that they have taken 2 x payments of £7.99 from the card without my authority. […] revenue by small print deception.” – reviewcentre.com

“Me and my wife both used Credit expert’s free service only to find a few months later we were being charged £6.99 a month for a free service we used once” – reviewcentre.com

“Joined in May 2010 and didn’t realise I’d be charged £7.99 per month if I failed to cancel – BECAUSE IT WAS CONCEALED SOMEWHERE OUT OF SIGHT.” – reviewcentre.com

“The expression ‘caveat emptor’ comes to mind. I, too, got ripped off for £5.95 for my “free” subscription since I believed Experian to be a reputable organization.” – complaintsboard.com

So what do you think? Are practices like this ever excusable?

Thanks for this insight Harry.

I am about to launch a service on my site which gives early adopters a free 1 month trial after which they are billed $X a month.

However, I don’t ever say “FREE” and am excruciatingly obvious about saying the trial period is 30 days.

I opted for auto subscribe (via PayPal) as the coding is a lot simpler and it’s easier for users to come to grips with. Their dashboard and monthly stats contain links to stop the service any time they like.

So, I assume that wouldn’t trigger a “Black Hat!!” call?

Tim, as long as you set users’ expectations in a clear, honest and upfront manner, then it’s not black hat. What you’ve described sounds absolutely fine (though it’s hard to judge from a textual description).

Just tried to activate ancestry.co.uk’s “free trial” and this post sprung to mind.

It’s a nice narrative. But I’m afraid it’s based on flawed data.

No one searches for creditexpert – they are 11 times more likely to search for credit expert (2 words). And when people search for that, there’s no scam suggestion.

Also, Google suggesting the word scam is not indicative of people searching for that. There are numerous cases of this being based on a mistake, a few blog posts – and of Google being successfully sued for libel over this issue.

I’ve drilled deeper into the data here: http://www.malcolmcoles.co.uk/blog/dont-believe-google-autocomplete-when-it-comes-to-scams/

I cross-posted this on Malcolm’s article. I’m posting here for readers of this blog as well. It’s a response to Malcolm’s point above, which I don’t think holds water.

—

Malcolm

I see where you are going with the point you are making, and of course we mustn’t believe what Google tells us, in the same way that we mustn’t believe what the media – or even our friends – tell us, without checking the evidence.

However, I believe your argument has a logical flaw.

You rightly state that “credit expert” is a more common search than “creditexpert”, however quantity of searches is not the only factor to assess in search data analysis; the quality of search intent is also relevant. You haven’t touched on the correlation between search intent and the search terms people use.

Searches for “creditexpert” are presumably many times more likely to represent a search intent for the specific service provided by UK company Experian called “Creditexpert” (all one word) than searches for “credit expert”, which implies a completely ambiguous search intent (and one for which the pool of searches is far larger, geographically speaking).

Let’s assume that people who want to find Experian CreditExpert type either “credit expert” OR “creditexpert” into the search engine. If you had to choose one of these terms on which to base an analysis, which one should you therefore choose?

A larger sample size doesn’t always provide more meaningful results.

Also I feel you have completely misinterpreted the implied search intention with your statement about the Google search “Where can I hire a hitman”. Firstly this doesn’t necessarily mean the searcher is looking for a hitman, from which you can conclude that lots of people actually want to hire a hitman (this is what you implied it meant in your article) – it could mean they are looking for the reference in a script of a very popular film, for example. Secondly, and more interestingly from a position of global liability law, who says that this search suggestion *should* reflect the search intention of the user? Why should Google not be allowed as an independent company to skew search results by suggesting things to users that they may not want, for the sake of amusement or interest? No – it’s not great if you do want to hire a hitman, but that’s sometimes the way the web works: learning through distraction.

I do however agree with your point that online brand degeneration can become a self-fulfilling prophecy when things are suggested to users. But Google is an independent company working in a market; who says they have a moral responsibility to provide users with some form of absolute truth?

Interesting point nonetheless.

Hi, Mat. The related searches that Google shows at the bottom of the page when you search are a good indicator of intent – and all the related searches for creditexpert suggest that people are in fact searching for the Experian service (one of the related terms is in fact Experian).

I don’t think I explained the hitman thing very well – I was trying to show what you are saying. You can’t conclude that lots of people are trying to hire a hitman just because Google autosuggests the phrase – in the same way that you can’t conclude a brand is a scam just because Google says so.

One thing you also have to remember is that hiding the words and keywords in smaller font is a big SEO no no and black hats are actually shying away from it. Great case for the auto suggest and scams as well Malcom.

re: the fakeness of what Experian and Credit Expert offer. It baffles me that Experian have somehow built up a massive reputation as a go-to source for reliable information about individuals. But it’s clear that they also over-sell what they provide and use as many psychological tricks to do this as possible. The ‘free’ use of Credit expert – where they emphasise the word ‘free’ to the hilt – is there to gull people in to 90% signing up and so that only at the last stage do they realise (in some cases…) that they will have to pay if they don’t cancel their ‘free subscription’ within a certain period. I think this is a trick as inevitably people will forget to cancel. Companies deny this is a trick saying ‘consumers know what they are signing up to’ but I believe it is exploitation of a human weakness that consumers don’t fully realise they have – the capacity to forget such a detail among all the other details in their busy daily life. Sure, there are many commercial practices around of this kind, but it doesn’t excuse them. The company is making money because the general public hasn’t woken up to the fact that even if they sign thinking they will cancel (to experian or any other service using this type of free offer), there is an inbuilt flaw in this thinking, as it is easier for humans to forget to cancel such an arrangement than they think.

but going back to what Experian provide – they also ‘fan up’ demand by playing on people’s fears, which then allows them to sell such a service to people frightened by the alarmist stories of id theft that they are only too happy to give publicity to. In effect, this is a company that has created its main market by exploiting people’s fears – of ID theft and suchlike. They directly target people’s fears.

Finally, what does one get for the service they provide? You get an ‘alert’ for every single tiny change that is made to your report, 98% of which, you find, are not even remotely related to there being a problem in your credit report – yet, receiving an unspecific ‘alert of a change to your credit report’ of course means you have to look at the credit report (worried) to see that the change they are talking about is harmless. Basically, whenever the bank updates them with a new monthly statement about your balance, you get an ‘alert’ from them as if something alarming has happened; and suchlike. You get loads of alerts which are basically an excuse for Experian to make it look like you are paying for something with your (unwanted) subscription you forgot to cancel – but at least 98% of these alerts are wasting your time.

Experian is an organisation built on a chance and a prayer that has totally lucked out in the way it is accepted as being of some use by the financial industry and similar. All it does is gather together details of what is on electoral registers – information which can be found elsewhere if you look – details of bank and credit card applications (which Experian managed to get such providers to agree to do based on the fact that it had got stuff like electoral register information about individuals on its records) – and little else (there might be details of mobile phone contracts and suchlike). oh there is date of birth of an individual (garnered from places like electoral register or the selfsame banks and credit card providers). The point here is that Experian and the other credit reference agencies are little more than databases with a few important piece of information about individuals – true you can’t get such an amalgamated reference point of information elsewhere very easily but it doesn’t take much for them to achieve their records (some good computer databases, and relationships with banks etc to get the information described, which isn’t that many relationships). Experian in particular of the credit reference agencies then sells to the general public how great it is in absolutely massive fashion, playing on people’s fears, and many consumers end up losing money to Experian as a result of their exploitative advertising.

Bad news all round – but I know the ‘company reps in disguise’ types who have made comments here will come up to disagree with me; nothing you can do about them can you? this is what pure capitalism leads to – pure sell, and to hell with actual values and decency by companies and their employees. ha ha, the jokes on us the citizens

I have found CreditExpert to be a rip-off and a scam. It is clearly un-ethical and meant to deceive.

I tried the service then cancelled as it didn’t tell me anything useful and you have to pay extra to actually get useful information. They continued to bill me for over a year after I cancelled. When I tried to cancel by phone and email said that I didn’t have an account – yet they still took money from my credit card even after I complained in writing AND refused to refund. During the whole time I did not receive a single credit report or email from them.

Pingback: Kyle Gawley - Digital Product Designer. Belfast, Northern Ireland